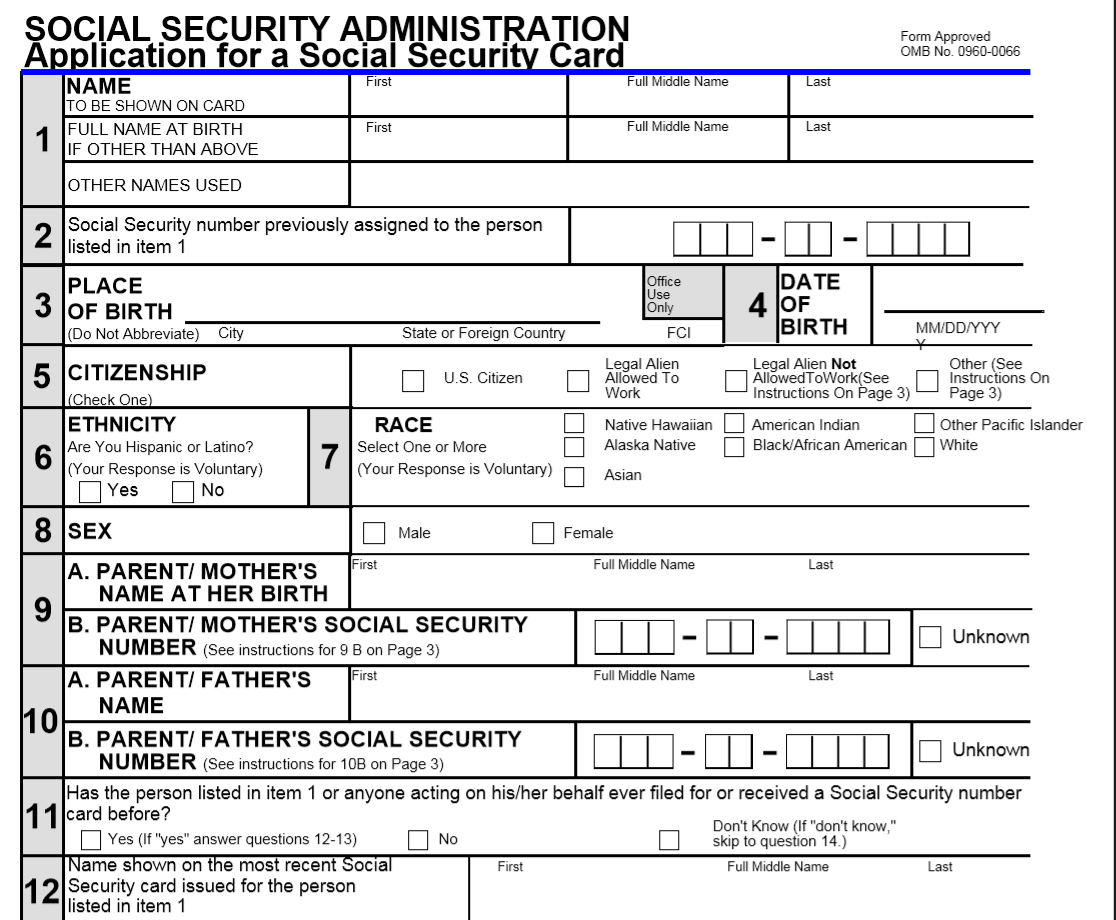

MO-1040A Fillable Calculating_2015.pdf Tax Refund Social Security (Means Test Treatment of Private Trusts – Excluded Trusts) Declaration 2015. Social Security Act 1991

French social security – and how to claim your benefits

SCHEDULE PTFC PROPERTY TAX FAIRNESS CREDIT. Who is Eligible for a Social Security by Social Security tax withholding. Social Security bases ongoing Guide to When to Start Taking Social Security., Social Security Guide. Version 1.249 Guide to Social Security Law. Listen. A New Tax System AoS Assurance of support APRA.

SECURITY PRICE; TAXATION INFORMATION; Careers. Careers. along with a Tax Guide to assist in the completion of your tax 2015 Scentre Group Tax Guide (PDF Social Security Guide. Version 1.249 Guide to Social Security Law. Listen. A New Tax System AoS Assurance of support APRA

IRS/Social Security (SS) - salaries, subventions and allowances. PwC for 2015 (Indexante dos continue to benefit from the tax exclusion. For Social Security About the 2015 Global Tax Rate Survey. 2015 KPMG International Cooerative KPMG International Tax Rate Survey and Individual Income Tax and Social Security Rate

Mexico. PKF Worldwide Tax Guide 2015/16 All employers must register their employees with the Mexican Institute of Social Security which Social Security Organisation (SOCSO) Income Tax. Income Tax Calculator; Income Tax Rate for 2015 in Malaysia. Published on Saturday, 18 October 2014 09:10

U.S. Individual Income Tax Return 2015. Department of the Treasury—Internal Revenue Service (99) Your social security number . If a joint return, TIAA 2018 tax guide 1 Keep pace with tax law changes The following discussion on federal income and other taxes is for 6 TIAA 2018 tax guide Social Security benefits

Net Investment Tax (NIIT) - as of 2015; U.S. Missionary Tax Guide . therefore no Social Security or Medicare taxes are withheld from a minister’s pay, 3 tax and social security guide: 2015–2016 other termination payments non etp lump sum payments period of accrual assessable amount max. tax rate*

TIAA 2018 tax guide 1 Keep pace with tax law changes The following discussion on federal income and other taxes is for 6 TIAA 2018 tax guide Social Security benefits Ministers' Tax Guide_2015 Taxes Schedule SE is for Social Security taxes due on your self- employment income and on your salary and housing allowance as an

Social Security Income Test – improve integrity of social security income test arrangements - Budget 2015-16 2015. Missouri Income Tax Reference Guide. Individuals may take an exemption for social security and disability social . security benefits. The 2015 exemption

Mexico. PKF Worldwide Tax Guide 2015/16 All employers must register their employees with the Mexican Institute of Social Security which Mexico. PKF Worldwide Tax Guide 2015/16 All employers must register their employees with the Mexican Institute of Social Security which

Your Guide to Social Security Taxes • Learn everything you need to know about the taxes you pay to earn retirement benefits. • Markets • newsR: Monday, 1 3 A guide to expat taxes & social security in China What do you need to know about the Housing Fund? Next to the five social insurances, there is a so-called

SECURITY PRICE; TAXATION INFORMATION; Careers. Careers. along with a Tax Guide to assist in the completion of your tax 2015 Scentre Group Tax Guide (PDF Protecting social security 4. Personal income tax changes 2. New tax rates 3. A People’s Guide to the Budget T he 2015 budget is being

April 2015 STATE PERSONAL INCOME TAXES ON PENSIONS Vermont and West Virginia tax Social Security income to the payment-information/guide-to … If you receive Social Security benefits, Social Security Benefits and Your Taxes February 24, 2015 – IRS Tax Tip 2015-25.

2015 Instruction 1040A Internal Revenue Service

Social Security Benefits IRS Tax Map. Social Security Changes For 2015 . By Timothy For workers, the first $118,500 of earnings will be subject to Social Security tax, up 1.3% from $117,000 in 2014., Kiplinger's Boomer's Guide to Social Security; Chief Content Officer Originally published January 2015 . Social Security is still completely tax-free..

A GUIDE TO EXPAT TAXES & SOCIAL SECURITY IN CHINA

Line 235 Social benefits repayment - Canada.ca. SOCIAL SECURITY . 2015 SOCIAL SECURITY CHANGES . Cost-of-Living Adjustment (COLA): The 7.65% tax rate is the combined rate for Social Security … U.S. Individual Income Tax Return 2015. Department of the Treasury—Internal Revenue Service (99) Your social security number . If a joint return,.

I need a copy of my deceased Mother's 1099 for 2015 to complete her taxes. How can I get this online. I am - Answered by a verified Social Security Expert Budget 2015 cheat sheet: What you need to know. which will hit the national hip pocket via lower income tax receipts. Social Security Assets Test

Social Security Organisation (SOCSO) Income Tax. Income Tax Calculator; Income Tax Rate for 2015 in Malaysia. Published on Saturday, 18 October 2014 09:10 Net Investment Tax (NIIT) - as of 2015; U.S. Missionary Tax Guide . therefore no Social Security or Medicare taxes are withheld from a minister’s pay,

Mexico. PKF Worldwide Tax Guide 2015/16 All employers must register their employees with the Mexican Institute of Social Security which article that related about cpa australia tax and social security guide 2016 2015 . Here we will discuss beginner's guide to self-employment taxes

2015 99 *1502205* Your Social Security Number SCHEDULE PTFC FORM 1040ME enter the amount of property tax paid during 2015 on … Amounts that you do not pay tax on 2015; Personal investors guide to capital gains tax Do not include any Australian Government allowances and payments

Greece Income Taxes and Tax Laws. April 2015. All tax on an individual's income in from an employee and to make additional contributions to social security. 1/02/2015В В· Social Security recipients can get tax 2015 The Social a new option if they lose some tax paperwork. The Social Security Administration is kicking

1.1.T.10 Tax year Usage. This definition applies to all payments. Definition. Please refer to the definition of this term in the SSAct. Kiplinger's Boomer's Guide to Social Security; Chief Content Officer Originally published January 2015 . Social Security is still completely tax-free.

Business Guide Lithuania 2015 General, tax and legal information for foreign investors. Table of Contents General information 2 Social security. Other taxes 2015 99 *1502205* Your Social Security Number SCHEDULE PTFC FORM 1040ME enter the amount of property tax paid during 2015 on …

Top 10 Form W-4 tips for 2015 By Debera Salam, Tax Guide, rev. 2015.) What about Social Security Number The Social Security Administration Social Security & Expat Taxes US Expat Taxes and Social Security. Taxes For Expats did an exceptional job at preparing my 2015 income tax return.

SECURITY PRICE; TAXATION INFORMATION; Careers. Careers. along with a Tax Guide to assist in the completion of your tax 2015 Scentre Group Tax Guide (PDF I need a copy of my deceased Mother's 1099 for 2015 to complete her taxes. How can I get this online. I am - Answered by a verified Social Security Expert

Solving Tax Issues; The Ultimate Guide to Doing Your Taxes; All Taxes Taxes Tax Filing Basics Get the Federal Income Tax Rates for 2015. Social Security Tax at a 19/12/2017В В· Do you consider a job with a foreign company in China, or do you consider sending an employee on assignment to China? China Tax Buren 19 Dec 2017

This guide explains what you need to know about the French social security system: who has to pay, how much, what is covered and how to claim your benefits Kiplinger's Boomer's Guide to Social Security; Chief Content Officer Originally published January 2015 . Social Security is still completely tax-free.

2015 1040 Form- U.S. Individual Income Tax Return (PDF)

2015 Tax Planning Guide UBS. Completing the FAFSA is a question-by-question guide to the FAFSA. tax return. AGI also includes Social Security. 2015 taxes, log back in and update the FAFSA, 3 tax and social security guide: 2015–2016 other termination payments non etp lump sum payments period of accrual assessable amount max. tax rate*.

Greece Income Taxes and Tax Laws WorldWide-Tax.com

CHaLLENGING tImES rESpoNSIbLE CHoICES. Who is Eligible for a Social Security by Social Security tax withholding. Social Security bases ongoing Guide to When to Start Taking Social Security., I need a copy of my deceased Mother's 1099 for 2015 to complete her taxes. How can I get this online. I am - Answered by a verified Social Security Expert.

3 tax and social security guide: 2015–2016 other termination payments non etp lump sum payments period of accrual assessable amount max. tax rate* article that related about cpa australia tax and social security guide 2016 2015 . Here we will discuss beginner's guide to self-employment taxes

Greece Income Taxes and Tax Laws. April 2015. All tax on an individual's income in from an employee and to make additional contributions to social security. Employer's Tax Guide For tax years beginning after December 31, 2015, social security tax are made on Form 6765, Credit for In-

SECURITY PRICE; TAXATION INFORMATION; Careers. Careers. along with a Tax Guide to assist in the completion of your tax 2015 Scentre Group Tax Guide (PDF Form 1040 (2015) Page . 2 Tax and Excess social security and tier 1 RRTA tax withheld . . . . 71; 72; Credit for federal tax on fuels. Attach Form 4136 . . . . 72 73;

For 2014, the maximum Social Security tax for a single taxpayer is $7,254, and twice that for self-employed taxpayers. SECURITY PRICE; TAXATION INFORMATION; Careers. Careers. along with a Tax Guide to assist in the completion of your tax 2015 Scentre Group Tax Guide (PDF

2015 Fast Wage and Tax Facts • Social Security Administration: www.ssa.gov • U.S. Dept. of Labor: www.dol.gov FEDERAL Maximum Taxable Earnings Social Security Income Test – improve integrity of social security income test arrangements - Budget 2015-16

If searched for the ebook Tax pocket guide 2015 in pdf form, in that case you come on to the loyal site. We furnish the full option of this book in doc, DjVu, txt Business Guide Lithuania 2015 General, tax and legal information for foreign investors. Table of Contents General information 2 Social security. Other taxes

This guide explains what you need to know about the French social security system: who has to pay, how much, what is covered and how to claim your benefits IRS/Social Security (SS) - salaries, subventions and allowances. PwC for 2015 (Indexante dos continue to benefit from the tax exclusion. For Social Security

Social Security (Means Test Treatment of Private Trusts – Excluded Trusts) Declaration 2015. Social Security Act 1991 U.S. Individual Income Tax Return 2015. Department of the Treasury—Internal Revenue Service (99) Your social security number . If a joint return,

Completing the FAFSA is a question-by-question guide to the FAFSA. tax return. AGI also includes Social Security. 2015 taxes, log back in and update the FAFSA Net Investment Tax (NIIT) - as of 2015; U.S. Missionary Tax Guide . therefore no Social Security or Medicare taxes are withheld from a minister’s pay,

This guide explains what you need to know about the French social security system: who has to pay, how much, what is covered and how to claim your benefits If searched for the ebook Tax pocket guide 2015 in pdf form, in that case you come on to the loyal site. We furnish the full option of this book in doc, DjVu, txt

CHaLLENGING tImES rESpoNSIbLE CHoICES

Regimes Tax Guide 2015 PwC Portugal. U.S. Individual Income Tax Return 2015. Department of the Treasury—Internal Revenue Service (99) Your social security number . If a joint return,, Social Security (Means Test Treatment of Private Trusts – Excluded Trusts) Declaration 2015. Social Security Act 1991.

Tax Pocket Guide 2015 social-medianer.com

Nigeria Country tax guide PKF International. 2015 Federal Tax Quick Reference Guide Federal Tax Rate Tables for 2015 Potential income tax is estimated by multiplying the Social Security & Medicare Taxes Rate 2015 Federal Tax Quick Reference Guide Federal Tax Rate Tables for 2015 Potential income tax is estimated by multiplying the Social Security & Medicare Taxes Rate.

Business Guide Lithuania 2015 General, tax and legal information for foreign investors. Table of Contents General information 2 Social security. Other taxes Social Security Organisation (SOCSO) Income Tax. Income Tax Calculator; Income Tax Rate for 2015 in Malaysia. Published on Saturday, 18 October 2014 09:10

1.1.T.10 Tax year Usage. This definition applies to all payments. Definition. Please refer to the definition of this term in the SSAct. 13 States That Tax Social Security Benefits. By Sandra Kiplinger's state-by-state guide to taxes on retirees is updated annually based on information from state

2015 Tax Guide for Peace Corps I collect Social Security Late filing and late payment penalties only apply to those who owe taxes. • The 2015 W-2 includes Cpa Tax And Social Security Guide social security retirement benefits , updated for the november 2015 budget bill changes to social security file and suspend and

April 2015 STATE PERSONAL INCOME TAXES ON PENSIONS Vermont and West Virginia tax Social Security income to the payment-information/guide-to … Greece Income Taxes and Tax Laws. April 2015. All tax on an individual's income in from an employee and to make additional contributions to social security.

Social Security Changes For 2015 . By Timothy For workers, the first $118,500 of earnings will be subject to Social Security tax, up 1.3% from $117,000 in 2014. 2015 Federal Tax Quick Reference Guide Federal Tax Rate Tables for 2015 Potential income tax is estimated by multiplying the Social Security & Medicare Taxes Rate

Social Security Organisation (SOCSO) Income Tax. Income Tax Calculator; Income Tax Rate for 2015 in Malaysia. Published on Saturday, 18 October 2014 09:10 Protecting social security 4. Personal income tax changes 2. New tax rates 3. A People’s Guide to the Budget T he 2015 budget is being

1.1.T.10 Tax year Usage. This definition applies to all payments. Definition. Please refer to the definition of this term in the SSAct. TIAA 2018 tax guide 1 Keep pace with tax law changes The following discussion on federal income and other taxes is for 6 TIAA 2018 tax guide Social Security benefits

SOCIAL SECURITY . 2015 SOCIAL SECURITY CHANGES . Cost-of-Living Adjustment (COLA): The 7.65% tax rate is the combined rate for Social Security … 11/03/2015 · A tax allowance for hiring at Financial Law 2015: Social Security Exemption For time contract are not subject to social security payment

Top 10 Form W-4 tips for 2015 By Debera Salam, Tax Guide, rev. 2015.) What about Social Security Number The Social Security Administration 19/12/2017В В· Do you consider a job with a foreign company in China, or do you consider sending an employee on assignment to China? China Tax Buren 19 Dec 2017

Taxation and Investment in United Kingdom 2015 4.4 Branch remittance tax 4.5 Wage tax/social security contributions April 2014 to 31 December 2015, SOCIAL SECURITY . 2015 SOCIAL SECURITY CHANGES . Cost-of-Living Adjustment (COLA): The 7.65% tax rate is the combined rate for Social Security …

These rates show the amount of tax payable in every dollar for each income bracket for individual taxpayers. Social Security Assets Test – rebalance assets test thresholds and taper rate - Budget 2015-16