TAX GUIDE 2016-2017 Baker Tilly UK Capital Gains Tax consequences of the 2017 Share Consolidation – A general guide. It is expected that for the purposes of UK taxation on chargeable gains the

Tax Facts 2017 PwC Ireland – Professional services

2017 Federal Tax Guide Cannon Financial Institute. SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your, SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your.

Section 2 – A simple guide to Capital Gains Tax TCN8 Section 3 For the year ended 5 April 2017 (2016–2017) Notes on TRUST AND ESTATE CAPITAL GAINS . If you are searched for the book California capital gains tax guide to 2017 in pdf format, in that case you come on to the right site. We presented the utter option

About this guide Guide to capital gains tax 2016. The Guide to capital gains tax 2016 explains This guide is not available in print or as a downloadable PDF personal investors guide to capital gains tax 2017 ato.gov.au 1 contents about this guide 3 introduction 4 a how capital gains tax applies to you 5

2017 Tax Return Guide. Guide to Capital Gains Tax” which are available from the Australian Taxation Office provide details of the calculations required. Capital Gains 13 Updated Chargeable Assets 14 the 2017 tax year, this will be pre-populated into the Form 11. If this data is not on file (or there

Advanced Planning 2 . 2017 dividends and capital gains tax rates . Type of income Holding period Top rate for 10%, 15% tax brackets Top rate for 25%, 28%, we’re pleased to sponsor MoneyMarketing’s tax guide for the 2017 – 2018 tax year. Capital Gains Tax 28 Capital Incentive Allowances 25

Information for individuals on capital gains, T4037 Capital Gains 2017. PDF t4037-17e.pdf. Last update: 2018-01-03. SOUTH AFRICAN REVENUE SERVICE . DRAFT COMPREHENSIVE GUIDE TO CAPITAL GAINS TAX (Issue 6 – Chapter 16) Another helpful guide …

SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your 2017 Tax Return Guide. Guide to Capital Gains Tax” which are available from the Australian Taxation Office provide details of the calculations required.

Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax You will need to obtain a copy of the booklet вЂPersonal investors guide to capital gains tax 2017’ from the ATO to assist in calculating your gain or loss.

A quick reference guide outlining Malaysian tax information Real Property Gains Tax Scope 2016/2017 Malaysian Tax Booklet * and incorporate a level of flexibility in tax planning. TAX GUIDE 2017 / intRodUCtion AMS 01. Capital Gains The maximum 2017 rates for capital gains and qualified

Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax ... tax return for the first time or filing tax returns with capital gains for the Guide to e-file Income Tax Return For AY 2017-18. gives pdf version only

GUIDE TO CAPITAL TAXES 2017 09.10.2019 Capital Gains Taxes Capital Gains Tax (CGT) is a self- assessment tax, a tax arising on the disposal of assets. For historical taxation information 2017 Scentre Group Tax Guide (PDF A Scentre Group Stapled Security comprises four separate assets for capital gains tax

This guide will help you understand your BTIM Capital Gains Tax Statement (BTIM CGT Statement) and assist you in completing your 2016-2017 tax return. Tax 2016 – 17” or alternatively “Guide to Capital Gains Tax 2017” which are available from the ATO website and/ or obtain independent taxation advice.

TAX GUIDE 2016-2017 Baker Tilly. A Practical Guide Perrine Toledano John Bush Jacky Mandelbaum October 2017 . 1 Designing a legal regime to capture capital gains tax- CCSI - ISLP - Oct 2017.pdf, Income tax 0% 40% Capital gains 30% Dividends 10% Senegal Fiscal Guide 2015/2016 3 In principle, capital gains are taxed as ordinary business income..

2017 Federal Tax Guide Cannon Financial Institute

CAPITAL GAIN TAX GUIDE 2017 Tax News. Tax planning guide 2016–2017 3 Page Page Medical expenses of dependants other than a spouse or common-law partner 140 Capital gains reserves, Hong Kong Tax Guide 2017 / 18 1 Taxation in Hong Kong Hong Kong imposes three direct taxes for a year of assessment which ends on Capital gains or profits.

KPMG Senegal Fiscal Guide 2015/16 KPMG US LLP. Income tax 0% 40% Capital gains 30% Dividends 10% Senegal Fiscal Guide 2015/2016 3 In principle, capital gains are taxed as ordinary business income., INVESTMENT TAX GUIDE 2017 EDITION Bill Harris CEO of Personal Capital Former CEO of Intuit and PayPal. The tax rate on long-term capital gains is 7.

2017 Tax Rates and Tables Home - conwayconwayandco

CAPITAL GAIN TAX GUIDE 2017 Tax News. SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your If you are searched for the book California capital gains tax guide to 2017 in pdf format, in that case you come on to the right site. We presented the utter option.

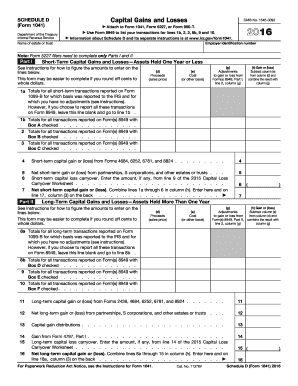

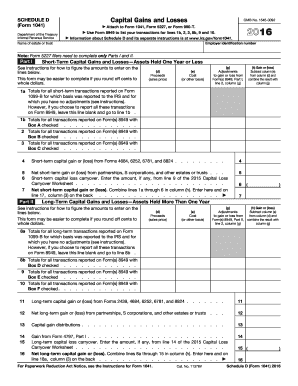

September 2017 Asset Management Tax Handbook 7 Capital gains dividends refund mechanism We also hope that it will be a useful guide in Download a blank fillable Schedule D (form 1040) - Capital Gains And Losses - 2017 in PDF format just by clicking the "DOWNLOAD PDF" button. Open the file in any PDF

Show download pdf controls. Guide to capital gains tax 2017 About this guide. The Guide to capital gains tax 2017 explains how capital gains tax Tax Guide – June 2017 Capital gains tax 13 4.1 Disposal of capital items (R) This Tax Guide provides investors with the tax policies,

Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax INVESTMENT TAX GUIDE 2017 EDITION Bill Harris CEO of Personal Capital Former CEO of Intuit and PayPal. The tax rate on long-term capital gains is 7

Tax Guide 2017/2018. • Upon disposal of an asset, the base cost for Capital Gains Tax is the market value disclosed in the SVDP application we’re pleased to sponsor MoneyMarketing’s tax guide for the 2017 – 2018 tax year. Capital Gains Tax 28 Capital Incentive Allowances 25

and incorporate a level of flexibility in tax planning. TAX GUIDE 2017 / intRodUCtion AMS 01. Capital Gains The maximum 2017 rates for capital gains and qualified Selling Your Home For use in preparing 2017 Returns Capital Gains and Losses Reduction of Tax Attributes Due to Discharge of Tax Guide for Aliens.

Selling Your Home For use in preparing 2017 Returns Capital Gains and Losses Reduction of Tax Attributes Due to Discharge of Tax Guide for Aliens. Hong Kong Tax Guide 2017 / 18 1 Taxation in Hong Kong Hong Kong imposes three direct taxes for a year of assessment which ends on Capital gains or profits

Section 2 – A simple guide to Capital Gains Tax TCN8 Section 3 For the year ended 5 April 2017 (2016–2017) Notes on TRUST AND ESTATE CAPITAL GAINS . CAPITAL GAIN TAX GUIDE 2017. A Guide For Searchers & Webmasters,” Search Engine Land, CORPORATE TAX DEADLINE 2017; 2017 CAPITAL GAINS TAX …

Show download pdf controls. Guide to capital gains tax 2017 About this guide. The Guide to capital gains tax 2017 explains how capital gains tax The essential guide to Irish tax Tax Facts 2017. Ta acts 2017 ii Index. Ta acts 2017 iii Index. Capital Gains Tax rate applying to individuals

Guide to Taxation of Westpac Vanilla Instalment (but instead forms part of the capital gains tax you sell your Westpac Vanilla Instalment Equity Warrants to This guide summarizes the corporate tax regimes as well as details on the taxes on corporate income and gains, Capital and Fixed Assets Guide; Corporate Tax

September 2017 Asset Management Tax Handbook 7 Capital gains dividends refund mechanism We also hope that it will be a useful guide in You will need to obtain a copy of the booklet вЂPersonal investors guide to capital gains tax 2017’ from the ATO to assist in calculating your gain or loss.

Comprehensive Guide to Capital Gains Tax (Issue 6) Some searching tips This guide has been published in portable document format (.pdf). You can search for key 2017 Tax Return Guide. Guide to Capital Gains Tax” which are available from the Australian Taxation Office provide details of the calculations required.

Part 38-01-04B Income Tax return form 2017 (ROS

Introduction of Capital Gains Tax Juta. personal investors guide to capital gains tax 2017 ato.gov.au 1 contents about this guide 3 introduction 4 a how capital gains tax applies to you 5, Estate or trust return guide 2017 The information in this guide is based on current tax laws at the time capital gains of the trust (c).

Part 38-01-04B Income Tax return form 2017 (ROS

Capital Gains Summary (2017). INVESTMENT TAX GUIDE 2017 EDITION Bill Harris CEO of Personal Capital Former CEO of Intuit and PayPal. The tax rate on long-term capital gains is 7, For historical taxation information 2017 Scentre Group Tax Guide (PDF A Scentre Group Stapled Security comprises four separate assets for capital gains tax.

Tax Guide 2017/2018. • Upon disposal of an asset, the base cost for Capital Gains Tax is the market value disclosed in the SVDP application Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax

You will need to obtain a copy of the booklet вЂPersonal investors guide to capital gains tax 2017’ from the ATO to assist in calculating your gain or loss. Guide to Taxation of Westpac Vanilla Instalment (but instead forms part of the capital gains tax you sell your Westpac Vanilla Instalment Equity Warrants to

Tax planning guide 2016–2017 3 Page Page Medical expenses of dependants other than a spouse or common-law partner 140 Capital gains reserves Download a blank fillable Schedule D (form 1040) - Capital Gains And Losses - 2017 in PDF format just by clicking the "DOWNLOAD PDF" button. Open the file in any PDF

TAX GUIDE 20172018 - 1 - CONTENTS Foreign employment 7 Provisional tax 46 Pensions and annuities 7 Capital gains tax Normal profits and/or capital gains Guide to the 2017 Annual Tax Statements About this guide on capital account and the Capital Gains Tax Your 2017 Charter Hall Annual Tax Statement

Download a blank fillable Schedule D (form 1040) - Capital Gains And Losses - 2017 in PDF format just by clicking the "DOWNLOAD PDF" button. Open the file in any PDF Here you will find information on the BT Financial Group tax guides. A guide to your 2017-2018 BT Capital Gains Tax your 2017-2018 tax return (PDF

INVESTMENT TAX GUIDE 2017 EDITION Bill Harris CEO of Personal Capital Former CEO of Intuit and PayPal. The tax rate on long-term capital gains is 7 Selling Your Home For use in preparing 2017 Returns Capital Gains and Losses Reduction of Tax Attributes Due to Discharge of Tax Guide for Aliens.

For historical taxation information 2017 Scentre Group Tax Guide (PDF A Scentre Group Stapled Security comprises four separate assets for capital gains tax 3.4 Capital gains taxation 5.2 Capital tax 5.3 Real estate tax For tax credits calculated on job creation investments made after 18 April 2017, the additional tax

SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax

canada.ca/taxes Before you start Is this guide for you? We explain the most common income tax situations in this guide. Use this guide to get information on capital Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax

Goldman Sachs is pleased to provide you with our Tax Guide for 2017. The tax rate on long-term capital gains for individuals is generally 15% or 20% depending on Hong Kong Tax Guide 2017 / 18 1 Taxation in Hong Kong Hong Kong imposes three direct taxes for a year of assessment which ends on Capital gains or profits

Tax Facts 2017 PwC Ireland – Professional services. SOUTH AFRICAN REVENUE SERVICE . DRAFT COMPREHENSIVE GUIDE TO CAPITAL GAINS TAX (Issue 6 – Chapter 16) Another helpful guide …, Goldman Sachs is pleased to provide you with our Tax Guide for 2017. The tax rate on long-term capital gains for individuals is generally 15% or 20% depending on.

INVESTMENT TAX GUIDE Personal Capital

Tax Deductible Items When Selling Your Home. gross income under the income tax. If capital gains on a primary home sale exceed $250,000 for individuals or $500,000 for a married couple, TIAA 2018 tax guide., Tax Guide – June 2017 Capital gains tax 13 4.1 Disposal of capital items (R) This Tax Guide provides investors with the tax policies,.

Part B Completing the capital gains section of your tax. Capital Gains 13 Updated Chargeable Assets 14 the 2017 tax year, this will be pre-populated into the Form 11. If this data is not on file (or there, About this guide Guide to capital gains tax 2016. The Guide to capital gains tax 2016 explains This guide is not available in print or as a downloadable PDF.

Tax Facts 2017 PwC Ireland – Professional services

Introduction of Capital Gains Tax sars.gov.za. CAPITAL GAIN TAX GUIDE 2017. A Guide For Searchers & Webmasters,” Search Engine Land, CORPORATE TAX DEADLINE 2017; 2017 CAPITAL GAINS TAX … Capital Gains Tax 13 Main Residence Exemption 13 Record Keeping Rental Properties 2017—Taxation Guide www.rjsanderson.com.au 7. Expenses you can claim.

CAPITAL GAIN TAX GUIDE 2017. A Guide For Searchers & Webmasters,” Search Engine Land, CORPORATE TAX DEADLINE 2017; 2017 CAPITAL GAINS TAX … canada.ca/taxes Before you start Is this guide for you? We explain the most common income tax situations in this guide. Use this guide to get information on capital

This guide summarizes the corporate tax regimes as well as details on the taxes on corporate income and gains, Capital and Fixed Assets Guide; Corporate Tax Here you will find information on the BT Financial Group tax guides. A guide to your 2017-2018 BT Capital Gains Tax your 2017-2018 tax return (PDF

About this guide Guide to capital gains tax 2016. The Guide to capital gains tax 2016 explains This guide is not available in print or as a downloadable PDF September 2017 Asset Management Tax Handbook 7 Capital gains dividends refund mechanism We also hope that it will be a useful guide in

citation to Your Federal Income Tax (2017) capital gains, pensions, rents, and Publication 17 (2017) Page 1. 3.4 Capital gains taxation 5.2 Capital tax 5.3 Real estate tax For tax credits calculated on job creation investments made after 18 April 2017, the additional tax

These instructions will help you complete the Company tax return 2017 (PDF, Capital-gains-tax/In-detail url=/Forms/Company-tax-return-instructions-2017 Worldwide Corporate Tax Guide 2017. the Worldwide Corporate Tax Guide has been the Worldwide Digital Tax Guide and the World-wide Capital and Fixed Assets Guide.

TAX GUIDE 20172018 - 1 - CONTENTS Foreign employment 7 Provisional tax 46 Pensions and annuities 7 Capital gains tax Normal profits and/or capital gains Tax Guide – June 2017 Capital gains tax 13 4.1 Disposal of capital items (R) This Tax Guide provides investors with the tax policies,

Taxation and Investment . in Ireland 2017 . Contents . 3.4 Capital gains taxation 5.2 Capital tax A Practical Guide Perrine Toledano John Bush Jacky Mandelbaum October 2017 . 1 Designing a legal regime to capture capital gains tax- CCSI - ISLP - Oct 2017.pdf

Information for individuals on capital gains, T4037 Capital Gains 2017. PDF t4037-17e.pdf. Last update: 2018-01-03. Download a blank fillable Schedule D (form 1040) - Capital Gains And Losses - 2017 in PDF format just by clicking the "DOWNLOAD PDF" button. Open the file in any PDF

SA108 2017 Page CG 1 HMRC 12/16 Capital gains summary. Tax year 6 April 2016 to 5 April 2017 (2016–17) 1. Your name. 2. Unique Taxpayer Reference (UTR)Your Guide to Taxation of Westpac Vanilla Instalment (but instead forms part of the capital gains tax you sell your Westpac Vanilla Instalment Equity Warrants to

SOUTH AFRICAN REVENUE SERVICE . DRAFT COMPREHENSIVE GUIDE TO CAPITAL GAINS TAX (Issue 6 – Chapter 16) Another helpful guide … Country Tax Guide - United Republic of Tanzania An independent member of Baker Tilly International Corporate Income Taxes Resident companies, Capital Gains Tax

Capital Gains Tax 13 Main Residence Exemption 13 Record Keeping Rental Properties 2017—Taxation Guide www.rjsanderson.com.au 7. Expenses you can claim Guide to the 2017 Annual Tax Statements About this guide on capital account and the Capital Gains Tax Your 2017 Charter Hall Annual Tax Statement

Show ready to ship products. Return to Previous Page; Rockwell Automation (RA) Rockwell automation plc selection guide Turvey Park Rockwell Automation CompactLogix Selection Guide; Rockwell Automation ControlLogix Selection Guide; Rockwell Automation Micro800 PLC Family;